In 2024, Finance, Real Estate & Business Services grew by 3.5%, contributing 0.8 percentage points to the South African GDP. Clients expect more, technology advances rapidly, and managing a practice grows increasingly complex.

That’s why we created the CIBA Practice Management Conference 2025: How to Make Your Firm Irresistible. Designed specifically for accountants and tax professionals who aim to grow smarter, not busier, this event provides practical tools to transform outdated models into outstanding practices.

Price

In Person and online full price: R1125

Online Full Price: R680

Event highlights:

- The Practice Makeover: Outdated to Outstanding

- Rebuilding Relevance in Your Firm – Practical steps to future-proof your practice.

- Burnout to Brilliance – Strategies to design a sustainable, enjoyable practice.

- Build the Practice Your Future Demands – Governance and growth essentials.

- Pricing, Revenue and Models

- Pricing That Pays – Shift to value-based pricing models.

- Reliable and Repeatable Revenue – Advisory services that clients never cancel.

- Smarter Lead Generation – Attract clients effectively without compromising fees.

- Protect What You’ve Built

- Death, Disputes and Divorce – Importance of Buy & Sell agreements.

- Protecting the Engine Room – Key person cover strategies for business continuity.

- Fix Your Firm’s Backbone: Governance and Tech

- Tech Is Not a Strategy – Align governance with innovation and growth.

- The Practice Tech Stack – Essential tools to save time and increase profitability.

- Stakeholder Summit: Ethics & Public Confidence

- Fighting Corruption – The accountant’s role in enhancing ethical standards.

- Compliance Spotlight: Trusts – Navigating changes and tax risks.

- Taxation Deep Dive

- SARS: Looking Ahead – Strategic insights and eVAT preparation.

- Audit-Ready Practices – Staying compliant and audit-proof.

- Know Your Client’s Rights – Insights from the Tax Ombud.

- CIPC Updates

- Upcoming Regulatory Changes – What accountants need to know now.

- Beneficial Ownership – Compliance and penalty avoidance strategies.

- Common Filing Errors – Tips for error-free submissions.

- Financial Crime Prevention (FIC)

- Once an Accountable Institution – Ongoing compliance obligations.

- Red Flags & Risk Indicators – Spotting and managing suspicious activities.

- Networking & Recognition

- Cocktail Event & Practice of the Year Awards – Celebrate excellence and connect with peers.

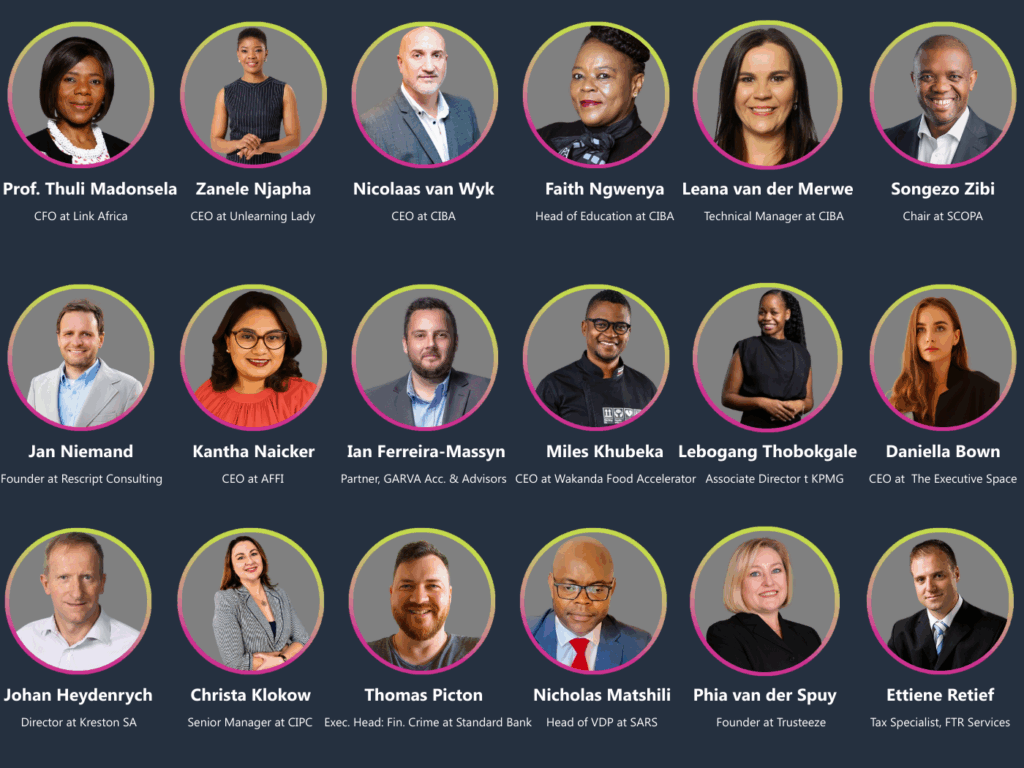

Meet the voices that matter:

- Nicolaas van Wyk, CEO, CIBA– Leading strategic transformations to build irresistible practices.

- Zanele Njapha, CEO, The Unlearning Lady– Specialist in helping firms rebuild relevance.

- Prof. Thuli Madonsela, Director, Centre for Social Justice & Law Faculty– Champion for accountability and ethical governance.

- Songezo Zibi, Chair, SCOPA– Advocate for ethics and anti-corruption in the public sector.

- Jan Niemand, Founder, ReScript Consulting– Expert in creating burnout-resistant practices.

- Kantha Naicker, CEO, Africa Future Foresight Institute– Expert in building future-proof practices.

- Ian Ferreira-Massyn, Partner, GARVA Accountants & Advisors– Authority on innovative pricing strategies.

- Miles Khubeka, CEO, Wakanda Food Accelerator– Specialist in leading organizational change.

- Paul Dunn, Co-Founder, B1G1– Expert on creating reliable, repeatable revenue streams.

- Daniella Brown, CEO, Executive Spaces– Specialist in smarter lead generation for accountants.

- Richard Foster, Owner, Richard Foster & Associates – Governance expert highlighting tech and compliance alignment.

- Alastair Barlow, Co-Founder, Stealth– Innovator in practice-saving tech stacks.

- Phia van der Spuy, Founder, Trusteeze– Authority on trust compliance and related taxation risks.

- Ettiene Retief, Tax Specialist, FTR Services– Specialist in taxation compliance and risk mitigation.

- Edward Kieswetter, Commissioner, SARS– Strategic insights on future tax trends and eVAT.

- Johan Heydenrych, Tax Director, Kreston SA– Expert in audit readiness and tax compliance.

- Yanga Mputa, Tax Ombud, Office of the Tax Ombud– Advocate for client rights and dispute resolution.

- Christa Klokow, Senior Manager, CIPC– Expert on regulatory updates affecting accountants.

- Lucinda Steenkamp, Senior Legal Advisor, CIPC– Specialist in beneficial ownership compliance.

- Shanee Kelly, Corporate Education & Compliance, CIPC– Expert in corporate deregistration and reinstatement processes.

- Thomas Lebete, Team Manager, CIPC– Specialist in annual returns compliance and amendments.

- Xillile Majija, Senior Operations Manager, FIC– Expert on maintaining compliance as an accountable institution.

- Thomas Picton, Executive Head: Financial Crime, Standard Bank – Authority on identifying and managing financial crime risks.

PLEASE NOTE IN PERSON TICKETS ARE SOLD OUT.

Please see the full brochure below.