Practical Continuing Professional Development and Lifelong Learning for Finance Professionals

Stay current with regulation, strengthen your professional expertise, and build the skills required in modern finance roles.

Explore webinars, courses, and learning opportunities designed for accountants working in finance departments, accounting practices, and financial leadership roles.

What is CPD?

Continuing Professional Development (CPD) ensures that finance professionals maintain the knowledge, skills, and competence required to perform their roles effectively throughout their careers.

As the finance profession evolves, accountants must continually strengthen their expertise to remain effective and relevant in the workplace.

Earn more

Earn more

The more up to date your skills are, the more valuable you become. Clients are willing to pay more for someone who knows the latest tax rules, financial reporting standards, or business practices. Employers also see CPD as proof that you are serious about your career.

Stay safe

Stay safe

CPD helps you avoid costly mistakes. If you don’t keep up, you risk penalties from SARS, pushback from regulators, or losing credibility with clients. Keeping your knowledge fresh protects both you and the people you serve.

Build trust

Build trust

When you invest in your learning, clients and colleagues see you as reliable, professional, and future-ready. CPD shows that you are not standing still but are always improving, and that builds long-term trust.

Choose Your CPD Path

Every professional journey is different. Select a channel aligned to your development

stage and compliance needs.

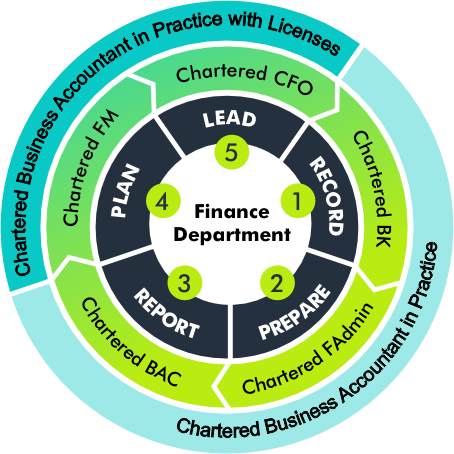

CAREER MAP

5-step Accounting cycle with CIBA Designations

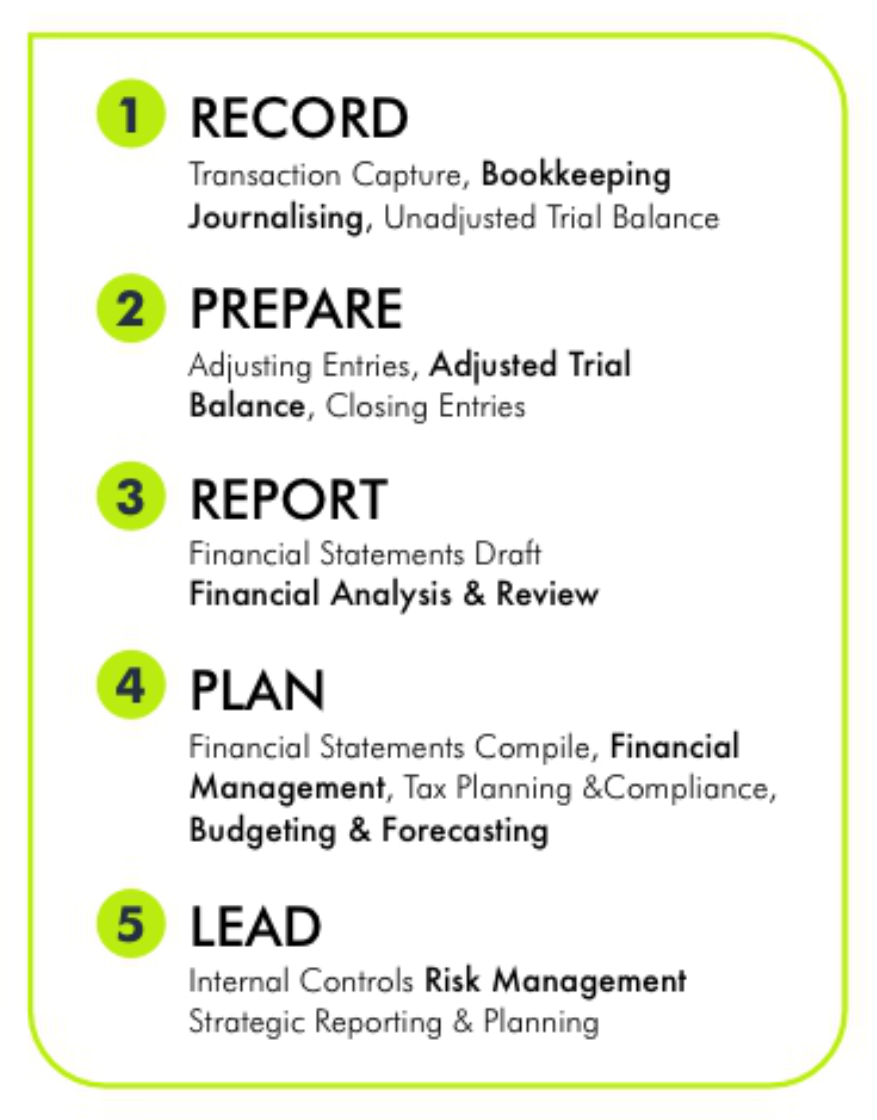

Explore CPD by Finance Area

Our CPD categories reflect the key functions performed within finance departments and accounting practices. This ensures that learning opportunities support the practical competencies required in the finance profession.

Invest in Your Professional Growth

Continuous development strengthens professional credibility and ensures finance professionals remain relevant in a changing business environment.

Explore learning opportunities, strengthen your expertise, and continue building the skills that define a trusted finance professional.